Investments

Introduction

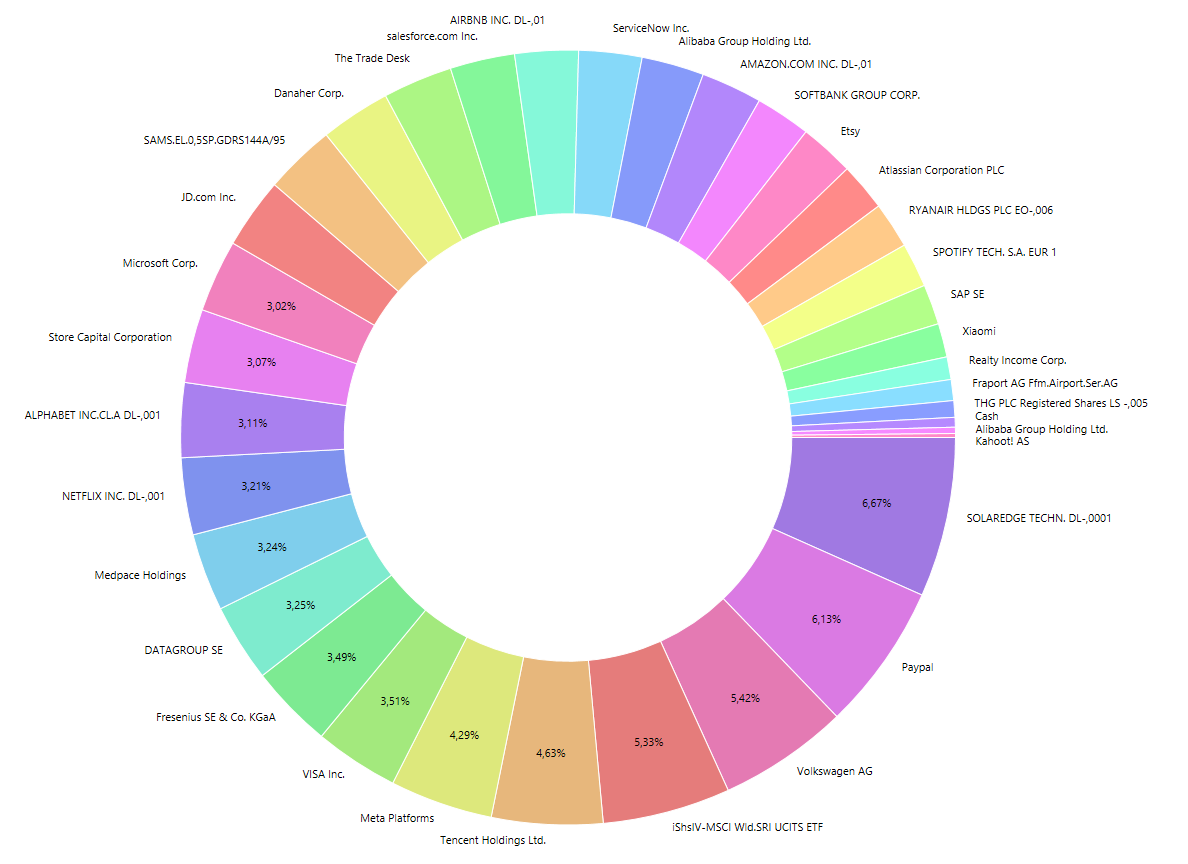

I am very open with my investments, because I want to encourage talking about them. Also, want to show everyone who does not invest that investing can be simpler than you might think. In the picture above, you can see all my investments and how much I own of each stock. Disclaimer: The cash position shown is only my cash position in my broker account.

Why am I investing?

Pension

If you live in Germany, then you might know that the current pension system is not a good one. When you retire without having additionally money saved up, then you know that you cannot live the same way as before retirement, since your wallet will be also much smaller.

Focus has calculated how much pension you would get, when your monthly income would have been throughout your career the same. According to Focus, you would get a monthly pension of 453 € if you have earned for 45 years a monthly income of 1000 € before tax.

1000 € --> 453 €/month

1500 € --> 680 €/month

2000 € --> 907 €/month

2500 € --> 1137 €/month

3000 € --> 1360 €/month

4000 € --> 1841 €/month

This makes clear that we would have to adjust our lifestyle if we don't save up money while working.

There are multiple ways how to invest or save money. You can go to your trust fund manager, you can invest on your own in ETFs, stocks, crypto or other things. But keep in mind: investing comes with a risk factor and you could lose lots of money. So, when investing, you should only invest, after calculating the risks and potential gains. If you want to minimize your losses, you can think about diversifying your portfolio.

Personal reasons

There are many reasons why I invest. One reason is to upgrade my pension. Another reason is that I learn quite a lot about the companies through investing. Before buying a stock, I try to understand what the business is doing and how it's business growth, revenue and debt are going to be. Through analysing the businesses, I also learn about new technologies I have never heard before.

During my university studies, I have learned that "money now > money tomorrow". The value of money decreases, because new money is generated over time (= inflation).

Strategy

My current strategy consists mainly out of a diversified high growth stocks portfolio. I say high-growth, but there are also a few other stocks in there as well, which I bought when they were priced cheaply.

Currently, about 15% of my portfolio is invested in Chinese companies. There was a time, where the percentage was much higher, but since the government is now regulating a lot, my Chinese stocks fell up to 50%. But for now, I will stay invested (09.01.2022).

I try to diversify my portfolio by investing in different sectors and different countries.