Top 5 reasons to stop investing in individual stocks

People invest in individual stocks to grow their money. But is this the most efficient way to generate wealth?

You have probably come across social media posts which suggested that you should invest. If you don't know what I mean, here are two examples:

Unfortunately, nobody talks about how much it can affect your life by spending your time with investing. This post is about the top 5 reasons why you should think twice about your investment strategy (provided you do stock-picking) and what alternatives you could pursue instead. At the end, I will tell you what my strategy is going to be after having done stock-picking for about two years.

5 reasons to quit stock picking now

- It takes a lot of time to research individual stocks.

- It will take up a lot of your time if you read finance news daily.

- If an invested stock is falling in its stock price, you will look multiple times into your depot.

- When you are unsure about your investments, it will lead to anxiety.

- You have to decide every month in what stocks to invest (decision-fatigue and time-consuming).

Basically, you will dedicate a lot of your precious time in your life with researching just to earn a few more percentages on your investments. Also, do not forget about the risks which come with doing stock-picking.

Do not understand me wrong. If you enjoy researching and investing, you can keep going. Just be aware of the opportunity costs.

As an alternative to stock picking, I recommend you to invest in a global index fund instead. This way, you can still keep the benefits of investing by spending less time.

Advantages of investing in an ETF

By deciding to invest every month in the same ETF, investors will have more time. This can be used for other activities like meeting up with friends or working on your health. An ETF is a collection of stocks which is managed by a computer.

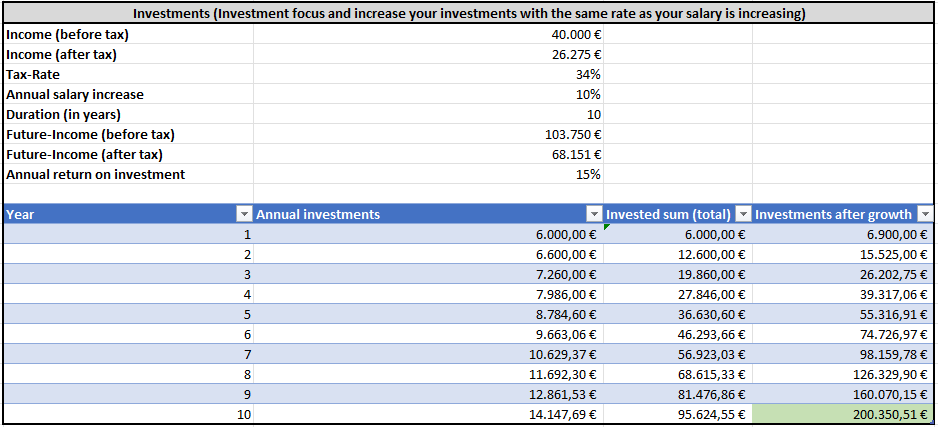

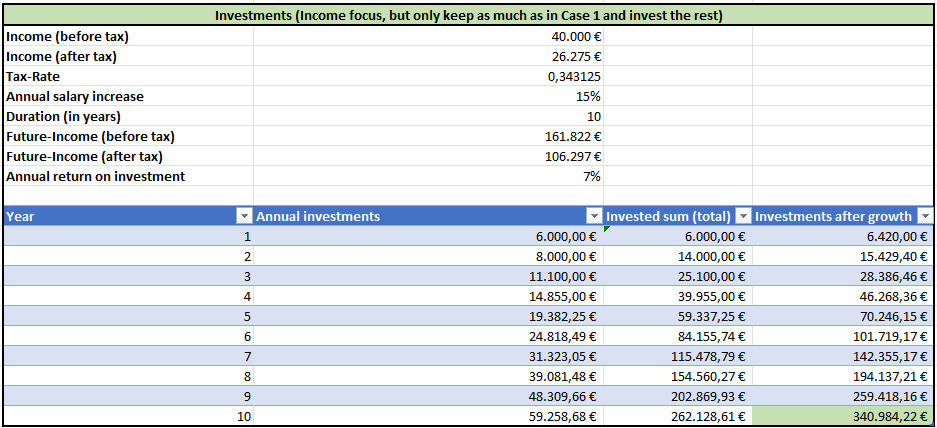

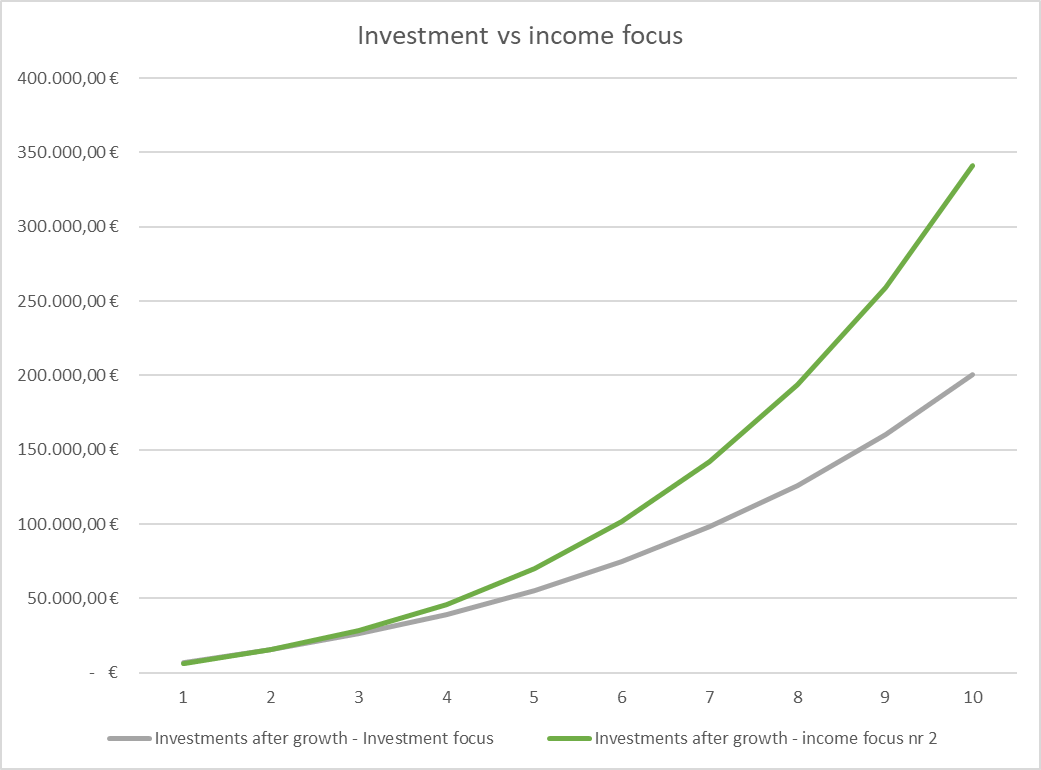

If you want to make more money, you can focus on your income or a side-hustle. I have created an excel sheet, with which you can calculate on your own if it is wiser to focus on increasing your annual salary or to keep your focus on investing.

By estimating your annual ROI (return on investments) and annual salary-raise for both situations, you can find out which of the two scenarios could be more profitable.

Here is a data example of the two cases:

When looking at these estimates, it is much more wise to focus on the income first. But you might have to switch your focus back to investing again as soon as you find out you cannot keep up your salary increase-rate.

If you're interested, you can just download the excel sheet and play with the numbers yourself:

What I will do from now on

I will keep my individual stocks as a buy and hold investor. From now on, I will only invest in the MSCI World SRI ETF. This is an ETF which contains stocks of 371 different companies (07.07.2022) which have a great ESG-score (environment-, social- and governance-score).

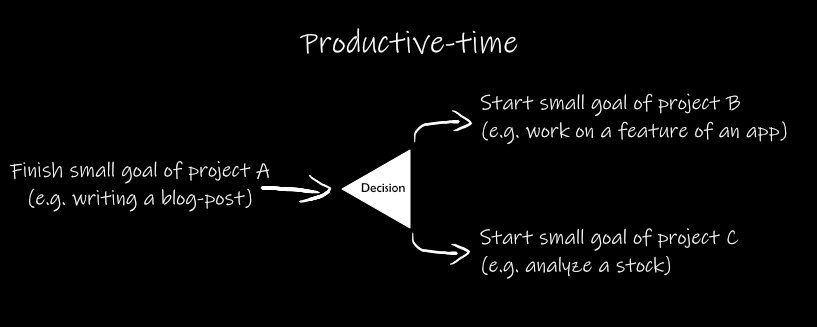

My personal reason for switching my investment-style is because I already have lots of side-projects: this blog and a new app which will be hopefully released this year. I also spend some time into researching into stocks and their companies.

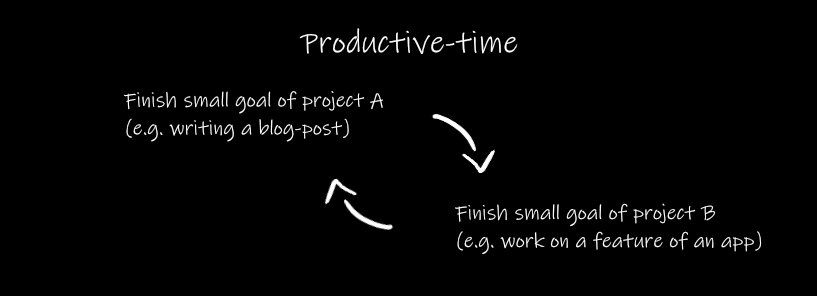

The problem is, that every time after I finish a small goal of one project, I always have to decide which project I want to work on next. When having three side-projects, this leads to decision fatigue and sometimes even to procrastination.

If I had two side-projects, it would be easier to manage. I could always be in a flow where I do not have to decide which project I want to work on next.

According to my estimates, I could generate more wealth by focusing on my income than by focusing on investing. Also, I hope that my side-projects will generate me some income some day.

By the way, I would still work on those projects even if I should be already financially independent, because these projects provide a value to other people.

I have been thinking about quitting stock-picking because me buying stocks does not provide a value to someone else. This made me question if I could use my time more meaningfully. With this post, I wanted to share my findings with you.

There is the famous saying that you have to maintain your relationships, health and your career to have a happy life. If you give one part of it too much focus, the other parts will suffer.

Getting a balance is what I'm striving for.